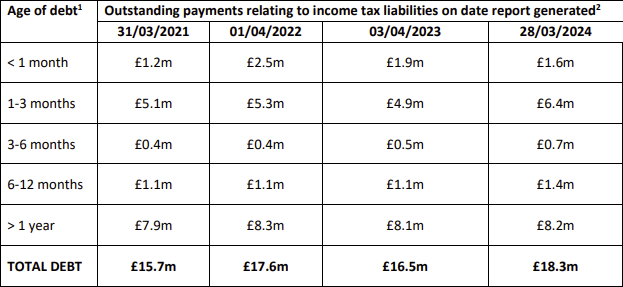

More than £8 million of the debt is more than a year old

Treasury is owed more than £18 million in outstanding Income Tax payments.

As of the end of 2023’s financial year, £8.2 million had been outstanding for more than a year.

Meanwhile debt less than a month old stood at £1.6 million.

Over the past three fiscal years just over £1 billion was generated from income tax receipts.

- 2020/21 - £237.7 million

- 2021/22 – £243.4 million

- 2022/23 - £276.3 million

- £2023/24 - £324.9 million (unaudited)

Debt can be outstanding for a number of years and includes debt in the hands of the coroners.

In comparison, since 2014, Income Tax has generated around £2.4 billion.

In response to a written Tynwald question, tabled by Onchan MHK Julie Edge, Treasury Minister Alex Allinson said: “When a taxpayer does not pay Income Tax by the due date, a reminder and subsequently a final demand is made. If payment is not received the case is referred to the Debt Collection Team.

“This team will attempt to agree a fair and affordable solution for the taxpayer to repay the debt owed.

"In a small number of cases where agreement cannot be reached the team will issue a warrant to the coroner.”

Balthane Roundabout targeted for Spring 2027 completion, says infrastructure minister

Balthane Roundabout targeted for Spring 2027 completion, says infrastructure minister

Jurby Junk founder dies aged 90

Jurby Junk founder dies aged 90

Treasury exploring replacement payment card scheme

Treasury exploring replacement payment card scheme

Liverpool ferry terminal dispute escalates in House of Keys as minister refuses to publish final cost

Liverpool ferry terminal dispute escalates in House of Keys as minister refuses to publish final cost